CreditAccess Grameen’s NCD Tranche I Issue Opens on November 14, 2022

Coupon Rate

up to 10.00% p.a. /Effective Yield up to 10.46% p.a.#

· Public Issue of Secured, Redeemable,

Non-Convertible Debentures (NCDs) of the face value of Rs. 1,000 each

· The NCD Issue for a Base Issue Size of

Rs. 250 crore with an option to retain oversubscription up to Rs. 250 crore

aggregating up to Rs. 500 crore, which is within the shelf limit of Rs. 1,500

crore

· NCDs are rated as IND AA-/Stable by

India Ratings and Research Private Limited

·

Effective Yield up to

10.46% p.a. and Coupon Rate up to 10.00% p.a. #

·

NCD Issue opens on

November 14, 2022, and closes on December 2, 2022, with an option of early

closure

·

The NCDs are proposed to

be listed on BSE Limited and NSE Limited. NSE is the designated stock exchange

for the Tranche I Issue

· Allotment on first-come-first-serve

basis

# Applicable for NCDs with a tenor of 60

months, for further details please refer Shelf Prospectus and Tranche I

Prospectus each dated November 04, 2022.

|

| Mr. Udaya Kumar, MD & CEO & Mr. Ganesh Narayanan, Deputy CEO & CBO, CreditAccess Grameen at launch of NCD Tranche |

CreditAccess Grameen Limited, a Non-Banking

Financial Company-Micro Finance Institution (NBFC-MFI) offering collateral-free

loans to women with an annual household income of Rs. 3,00,000 with the primary focus to provide income generation loans, has filed Tranche I

prospectus for public issue of secured, redeemable, non-convertible debentures of the face value of Rs. 1,000 each. The base issue size is Rs. 250 crore with

an option to retain oversubscription up to Rs. 250 crore, aggregating up to Rs.

500 crore, which is within the Shelf limit of Rs. 1,500 crore (“Tranche I

Issue”).

The Tranche I Issue opens on Monday, November 14, 2022, and closes on Friday, December

2, 2022, with an

option of early closure. The NCDs are

proposed to be listed on BSE Limited and NSE Limited (collectively, “Stock

Exchanges”) with NSE as the Designated Stock Exchange for the Issue. The

NCDs have been rated IND AA-/Stable by India Ratings and Research Private

Limited.

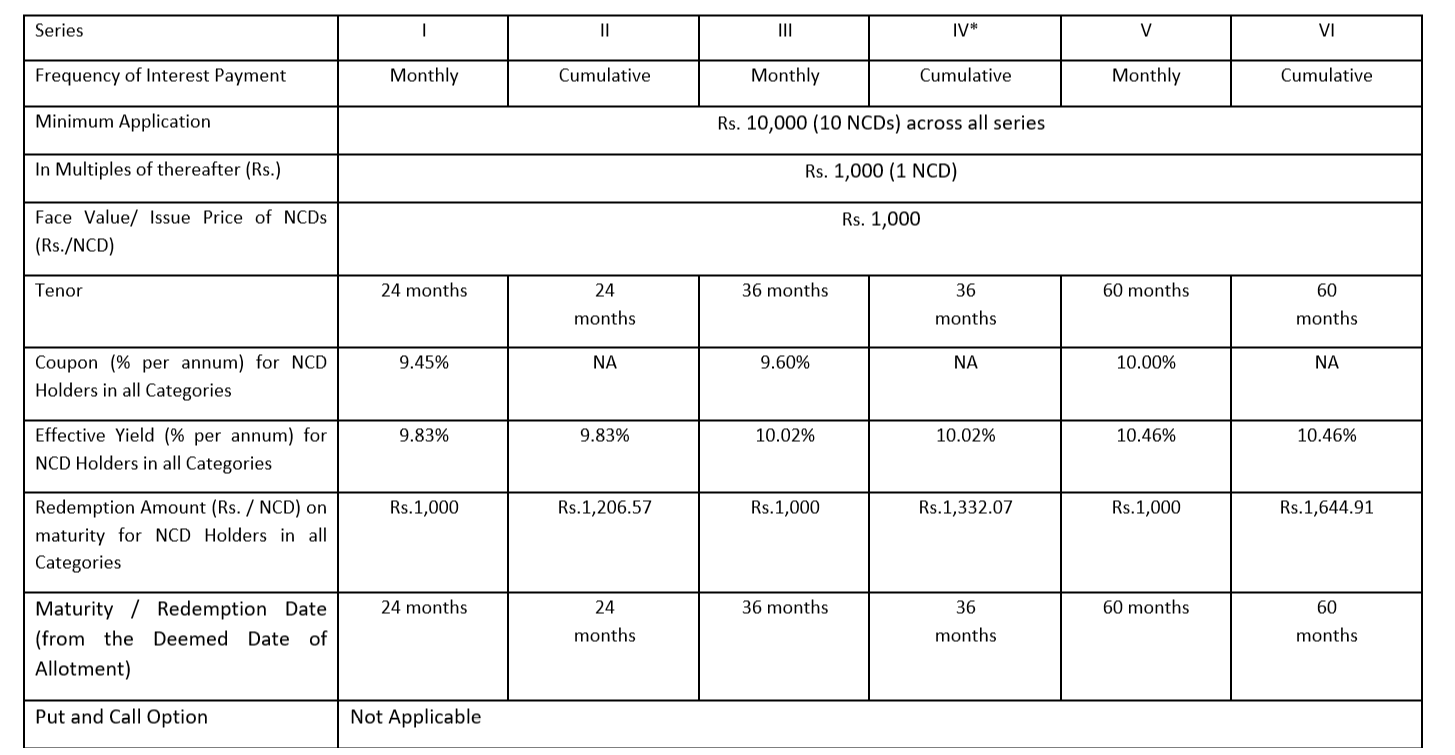

The minimum application

size would be Rs. 10,000

(i.e. 10 NCDs) and thereafter in multiples of Rs. 1,000 (i.e. 1 NCD)

thereof. This issue has tenure options of 24 months, 36

months and 60 months for secured NCDs with monthly and cumulative coupon

payment modes being offered across series I, II, III, IV, V and VI. Effective

yield (per annum) for NCD holders in all Categories ranges from 9.83% to 10.46%

per annum. Amount on maturity for NCD holders in all Categories under the

cumulative coupon payment option ranges from Rs. 1,206.57/- to Rs. 1,644.91/-.

Out of the Net proceeds of the Tranche I Issue, at least 75% shall be

utilised for the purpose of onward lending, financing, and for repayment of

interest and principal of existing borrowings of the Company and a maximum up

to 25% will be utilised for general corporate purposes.

As at September 30, 2022, the Company has a Gross AUM of Rs. 16,539.11

crore on a consolidated basis with presence through 1,684 branches and 10,826

loan officers in India.

The terms of each series of Secured NCDs, offered under Issue are set out below:

*Our Company shall allocate and allot Series IV NCDs wherein the Applicants have not indicated the choice of the relevant NCD Series.

A. K. Capital Services Limited is the Lead Manager to the Tranche I

Issue. Catalyst Trusteeship Limited is the Debenture Trustee and KFin

Technologies Limited is the Registrar to the Tranche I Issue.

Please note that the Basis of Allotment under the Issue will be on the

basis of the date of upload of each application into the electronic book of the

Stock Exchanges in accordance with the SEBI Operational Circular. However, from

the date of oversubscription and thereafter, the allotments will be made to the

applicants on a proportionate basis. For further details, refer section titled

“Issue Procedure” on page 93 of the Tranche I Prospectus dated November 4,

2022.

About CreditAccess

Grameen Limited:

CreditAccess

Grameen Limited (“Company”) is India’s largest microfinance institution,

headquartered in Bengaluru, Karnataka, and recognized by the Reserve Bank of

India. CreditAccess Grameen led by T. Muniswamappa Trust commenced operations

in May 1999 and subsequently, in 2007, the microfinance operations were

transferred into an NBFC. The Company has assets under management (AUM) of Rs.

16,539.11 crore on a consolidated basis (including its subsidiary, Madura Micro

Finance Limited (MMFL)), of September 30, 2022.

As of

September 30, 2022, the Company’s footprint spans 14 states and 1 UT, powered

by a network of 1,684 branches servicing

approximately 37.98 customers. The Company has 15,667 full-time

employees on a consolidated basis as of March 31, 2022. It also offers retail

finance products to support the evolving needs of its existing customers. The

promoter group, CreditAccess India N.V. held a 73.74% stake in the company at

end-September 2022.

The

Company’s consolidated gross stage 3 ratios (60-day non-performing asset

recognition policy for group loans and 90-day recognition policy for retail

finance) decreased to 3.65% at FYE22 from 4.45% at FYE21, while the net stage 3

ratio stood at 1.34% against 1.44% with a provision coverage ratio of 64.67%.

The Company’s consolidated

revenue from operations stood at Rs. 2,742.82 crores for the fiscal 2022 and

consolidated profit for the year was Rs. 357.10 crores. The consolidated profit

rose from Rs. 131.40 crore for the fiscal ended March 31, 2021 to Rs. 357.10

crore for the fiscal ended 31 March 2022 and total assets for the fiscal ended

31 March 2021 stood at Rs. 15,060.23 crore to Rs. 17,394.75 crore for the

fiscal ended 31 March 2022, on a consolidated basis.

Post a Comment